| Hey, it's Andrey here... I've been heads down for the past 45-50 days retooling and updating all my listing getting programs, tactics, and methods. Sharpening the proverbial axe, if you will. If you've been running any kind of digital marketing, then you already know the past 6 months have seen many changes in terms and rules across the main platforms (Google, YouTube, Facebook, IG, etc,.) So it called for a wholesale update on my end. As a spring launch special, I'm making access to the updated version of Social Signaling Method available for $50 for one week, starting today. This update includes:

If you want to jump in on this, hit REPLY and let me know. It's a one-time payment of $50 to access Social Signaling Method, fully updated for 2025. Let's get these listings! PS - Social Signaling Method normally sold for $297. The updated 2025 version will be selling for $497. This spring launch special pricing of $50 is available to you because you've been a long-time subscriber of mine. . . Hello, and thank you for taking the time to read this email. This message is part of an ongoing conversation between us, and I want to take a moment to ensure you have full transparency about why you received this message, how your information is handled, and what to expect from future emails. Why You're Receiving This EmailYou're receiving this email because at some point, you opted in to receive updates, news, or information on a specific topic we've previously discussed or shared. Whether it was through a subscription, a form submission, or another form of communication, your information was shared willingly, and we respect your decision to connect with us. If you're wondering about the nature of our correspondence, rest assured that we aim to keep all emails relevant, timely, and free from unnecessary clutter. This includes respecting your inbox and refraining from sending irrelevant messages. Your Privacy is ImportantWe value your trust and take your privacy very seriously. The information you provide is securely stored and never shared, sold, or used outside the purpose for which you provided it. If you ever want to review how we handle your data, feel free to contact us directly. Transparency is our priority, and we're happy to address any questions you might have. You are always in control of the information you share. If you feel that any part of your subscription or interaction needs clarification, let us know. We're here to provide accurate answers and ensure your satisfaction. How to Unsubscribe or Manage Your PreferencesWe understand that everyone's inbox is different. If you ever find our emails no longer relevant, there's no hard feelings. You can easily manage your email preferences or unsubscribe using the link provided below. By clicking the unsubscribe link, you'll be taken to a page where you can either adjust your communication preferences (such as receiving fewer emails or only on specific topics) or completely remove yourself from our list. The process is straightforward, and any changes will take effect promptly. We don't use tricks or gimmicks to keep you subscribed. Our priority is to ensure that our emails add value to your day, and if they don't, we respect your decision to part ways. Accessibility and CommunicationIf you have any trouble accessing the unsubscribe page, managing preferences, or understanding why you're receiving this email, you can reach out directly to our support team at andrey@listingacademy.net. We aim to provide a response within a reasonable time frame and address your concerns effectively. Our communication is designed to be as inclusive as possible, but we know there's always room for improvement. If you have any feedback on how we can make our emails more accessible or relevant, please don't hesitate to share. A Commitment to Non-Intrusive EmailsWe aim to create a non-intrusive communication experience. This means we won't overwhelm your inbox with excessive messages, and we work hard to ensure our content remains clear and concise. The purpose of this email is to stay connected with you and provide updates or information that we believe is meaningful. If we ever fail to meet these standards, we encourage you to let us know. Feedback, whether positive or constructive, is always appreciated. Your thoughts help us understand how we can do better and improve our communication approach. While we cannot guarantee every suggestion will be implemented, we will take the time to carefully review and consider your input. Contact InformationIf you'd like to get in touch with us outside of managing your preferences, here's how you can reach us:

We strive to ensure all communication channels are open and readily available to you. Whether it's a question, comment, or concern, our team is ready to assist. Legal InformationWe comply with all applicable laws and regulations regarding email communication. This includes adhering to anti-spam laws and maintaining the highest standards for consent-based communication. Your trust matters, and we work diligently to ensure every email you receive meets these requirements. If you need further clarification on our compliance policies or legal obligations, please feel free to ask. Transparency and accountability are central to our communication strategy, and we're happy to provide additional details if needed. A Final NoteEmails are one of the many ways we stay connected, but we understand they aren't perfect for everyone. If there's another way you'd prefer to communicate or stay updated, let us know. Whether it's through social media, a direct call, or another channel, we're open to finding the most effective way to share information with you. We want to emphasize that our goal is never to disrupt or clutter your inbox. Every email sent is intended to provide value, and we genuinely appreciate your time and attention. Thank you for allowing us to stay in touch with you. This footer was designed to ensure transparency, provide essential information, and give you full control over your communication preferences. We hope it meets your expectations, but if there's anything you'd like to see improved, we're always here to listen. |

Wednesday, April 16, 2025

Zillow farm (going live)

| I'm getting ready to jump on a brand new live webinar, where I show you how I get 50-60 leads per month directly from Zillow -- at $0.00 cost . "How to farm Zillow for $0.00 leads" >>> Click to join the webinar now <<< I'm going to show you how to take 1 listing per week. All from free Zillow leads. Here's what you'll get just for attending: ⚡️ Zillow playbook See you there. -Chris Jones |

Starting Soon: How To Dominate the For Sale By Owner Niche

|

Farming Zillow leads?

| Most agents hate Zillow. Personally, I love them. Because I've figured out how to "farm" them for free leads. It's a simple hack that takes less than 1 hour to implement. So... you can pay zillow $3k per month for 2 leads. Or you can "farm" 53 leads for $0.00. Want to see how? I'm doing a free webinar later today. Webinar: How to farm Zillow for free leads Statistically, all the best leads in your market will use Zillow today.

And you can buy those leads from Zillow -- for $1-2k per lead 😱 Or you can farm them for free. I'll break down the process step-by-step. The whole thing takes 1hr to implement, then you'll reap free leads continuously. But we only have 250 seats, so you have to register. >>> ONE CLICK REGISTER HERE <<< Here's what you'll get for attending:

This will be live, so I hope to see you there. -Chris Jones |

Tuesday, April 15, 2025

Glimmer Finance — The First Real-World Asset Marketplace on Solana

🏢 Glimmer Finance — The First Real-World Asset Marketplace on Solana

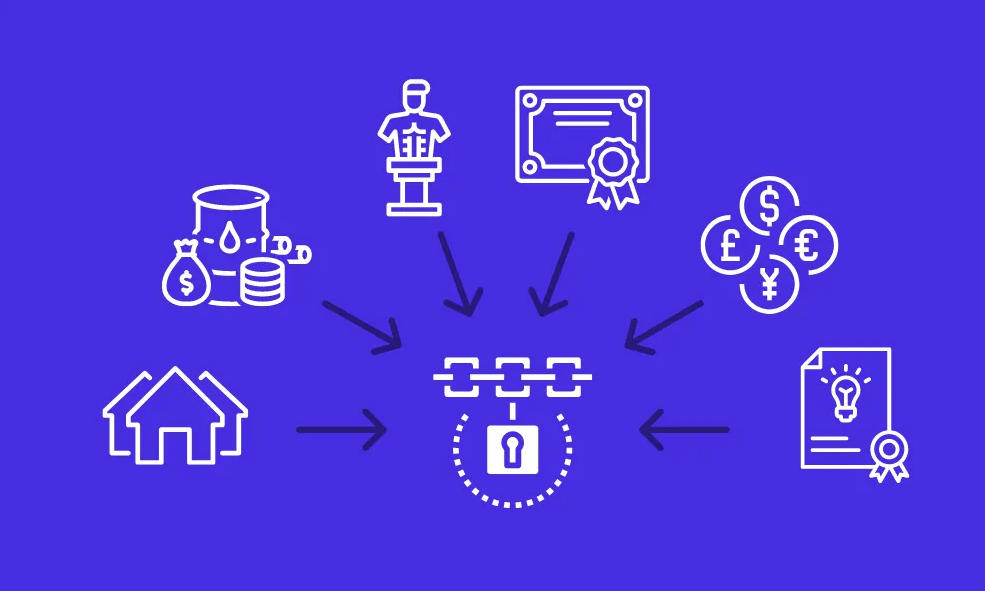

Imagine owning a piece of a Manhattan penthouse, a gold bar, or a vintage Ferrari — all for the price of a coffee. Sounds like a dream, right? Welcome to Glimmer Finance, a decentralized marketplace on the Solana blockchain that's turning this dream into reality by tokenizing real-world assets (RWAs). Whether you're a crypto newbie or a seasoned investor, Glimmer Finance offers a transparent, accessible, and innovative way to invest in assets once reserved for the ultra-wealthy. And with its ongoing $GLIMM token presale — where prices rise as time progresses — now's the perfect moment to dive in.

In this article, we'll explore how Glimmer Finance is revolutionizing asset trading, why Solana is the ideal blockchain for this mission, and how you can join the presale to be part of this groundbreaking ecosystem. Let's break it down.

Why Glimmer Finance Matters

The world of finance is changing. Traditional investments like real estate or commodities often come with high barriers — think million-dollar price tags or complex legal processes. Glimmer Finance tears down these walls by tokenizing RWAs, allowing anyone to own a fraction of high-value assets. Built on Solana, known for its lightning-fast transactions and low fees, Glimmer ensures a seamless experience that's both secure and cost-effective.

What sets Glimmer apart? It's not just about trading tokens; it's about democratizing wealth. By leveraging Solana's scalability and AI-driven tools, Glimmer makes investing inclusive, transparent, and smart. As reported by CryptoPotato, Glimmer Finance is the world's first RWA presale on Solana, marking a pivotal moment in bridging traditional finance with Web3.

How Glimmer Finance Works

Glimmer Finance simplifies the complex world of RWA investment into a user-friendly platform. Here's how it brings tokenized assets to life:

1. Asset Tokenization

Asset owners can onboard their properties, commodities, or luxury goods through a rigorous process:

- Submission: Owners provide proof of ownership, valuations, and legal documents.

- Verification: Glimmer's AI and compliance teams ensure everything checks out.

- Tokenization: Approved assets are converted into digital tokens via smart contracts.

- Listing: Tokens are listed on the marketplace for trading.

This process ensures transparency and trust, with all transactions recorded on Solana's immutable blockchain.

2. Fractional Ownership

Glimmer's standout feature is fractional ownership, which lowers the entry barrier for investors. For example:

- A $1 million property can be split into 1 million tokens.

- You could own a piece for just $1, gaining exposure to real estate appreciation or rental income.

This approach enhances liquidity and diversifies portfolios, making high-value assets accessible to all.

3. AI-Powered Insights

Glimmer integrates artificial intelligence to supercharge decision-making:

- Asset Selection: AI identifies high-potential assets for tokenization.

- Market Predictions: Real-time analytics provide insights into trends and risks.

- Risk Assessment: Tools like the "Average Risk Score" help you evaluate investments.

These features empower users to invest smarter, not harder.

The Power of Solana

Why Solana? It's the backbone that makes Glimmer Finance possible. Solana's architecture, with its Proof-of-History consensus, handles over 50,000 transactions per second, making it the fastest blockchain for RWA trading. Its low transaction costs — often fractions of a cent — ensure that investors keep more of their returns. As noted in a Medium article by the Harkness Institute, Solana's scalability and robust ecosystem make it ideal for RWA projects like Glimmer.

Solana's recent milestones, like Homebase tokenizing a rental property, show its real-world potential. Glimmer builds on this foundation to create a marketplace that's fast, secure, and globally accessible.

The $GLIMM Token and Presale Opportunity

At the heart of Glimmer Finance is its native token, $GLIMM, which powers the ecosystem. With a total supply of 5 billion tokens, $GLIMM offers multiple utilities:

- Fee Discounts: Pay lower trading fees by holding $GLIMM.

- Staking Rewards: Earn passive income with attractive APYs.

- Governance: Vote on platform decisions.

- Liquidity Incentives: Get rewards for supporting trading pairs.

The $GLIMM presale is live now, but act fast — the price increases as the presale progresses. Currently, 30% of the token supply is allocated to the public sale, with 5% unlocked at the Token Generation Event (TGE) and the rest vesting over 14 months. This structure ensures steady growth and long-term value.

Join the presale today using this referral link: https://glimmer.finance/SEXeAPgIZLu7. By participating, you're not just investing in tokens — you're securing a stake in the future of decentralized finance.

Key Features of the Glimmer Marketplace

Glimmer's marketplace is designed for both novice and expert investors. Here are its standout features:

- Diverse Assets: Trade real estate, commodities, luxury goods, and more.

- Real-Time Liquidity: Buy and sell instantly with AI-driven pricing.

- User-Friendly Design: Navigate the platform with ease, regardless of experience.

- Blockchain Transparency: Every transaction is recorded on Solana's ledger.

These features make Glimmer a one-stop shop for RWA investing, as highlighted in posts on X praising its accessibility and AI integration.

Security and Compliance

Investing in RWAs requires trust, and Glimmer delivers with robust security and compliance measures:

- KYC/AML: Partnered with Parallel Markets for fast, secure identity verification.

- Data Protection: AES-256 encryption and GDPR-compliant storage safeguard user data.

- Smart Contracts: Automated, transparent transactions reduce intermediary risks.

These protocols ensure a safe environment, building confidence for users worldwide.

https://medium.com/media/4a1b3bcff6f81ffcf8e6f1132fbce681/hrefThe Road Ahead

Glimmer Finance has an ambitious roadmap:

- Q2 2025: Presale and community building.

- Q3 2025: Beta platform launch with AI features.

- Q1 2026: Expanded asset listings and risk tools.

- Q2 2026: Multi-chain integration with Ethereum and others.

By Q3 2026, Glimmer aims to be the leading RWA marketplace, with deflationary token burns to boost $GLIMM's value.

Why You Should Join Glimmer Finance

Glimmer Finance isn't just another crypto project — it's a movement to make wealth-building accessible to everyone. Whether you're looking to diversify your portfolio, earn passive income through staking, or simply explore the future of finance, Glimmer has something for you. The ongoing $GLIMM presale is your chance to get in early, with prices rising as the campaign advances.

Take action now: Visit https://glimmer.finance/SEXeAPgIZLu7 to join the presale and become part of this revolutionary ecosystem. By using this referral link, you're supporting the community and securing your place in the RWA revolution.

What do you think about tokenized assets? Have you explored RWA platforms before, or is Glimmer Finance your first step into this space? Share your thoughts in the comments below — I'd love to hear your perspective!

source: https://raglup.medium.com/glimmer-finance-the-first-real-world-asset-marketplace-on-solana-0ae518f9c120?source=rss-f56f44caad34------2

The MANTRA Meltdown: Unraveling a $6 to $0.50 Crypto Crash

In the volatile world of cryptocurrency, few events have sparked as much controversy and speculation as the dramatic collapse of Mantra's OM token, plummeting from nearly $6 to $0.50 in a single day on April 13, 2025. This catastrophic 90% drop wiped out over $5 billion in market capitalization, leaving investors reeling and the crypto community scrambling for answers. Was it an insider dump, a cascade of reckless liquidations, or something else entirely?, this article dissects the Mantra meltdown, explores competing theories, and reflects on the broader implications for the crypto industry.

A Catastrophic Collapse: The Numbers Tell the Story

On April 13, 2025, Mantra's OM token, which had been trading at a high of nearly $7, experienced a freefall, bottoming out at $0.40 before stabilizing around $0.52. This represented a staggering loss of over 90% of its value in mere hours. For investors, the impact was devastating: a $10,000 investment was reduced to less than $1,000. The speed and scale of the crash raised immediate red flags, prompting intense scrutiny from the crypto community and media outlets alike.

Mantra, a project known for its ambitious plans to tokenize real-world assets (RWA) worth over $1 billion in collaboration with a firm from the United Arab Emirates, had been a darling of the crypto world. Its market cap had propelled it into the top 50 projects, and its community was buzzing with optimism. So, what went wrong?

Theory 1: Insider Dumping and a Potential Rug Pull

The first theory to emerge pointed fingers at insiders. Social media erupted with accusations that team members or early investors orchestrated a massive sell-off, dumping millions of OM tokens onto exchanges like Binance and OKX. This speculation was fueled by data from blockchain analytics platforms Lookonchain and Arkham Intelligence, which identified 17 wallets moving 43.6 million OM tokens — worth approximately $227 million — before the crash. Notably, wallets allegedly linked to Laser Digital, a Nomura-backed investor in Mantra, and Shorooq Partners, another investor, were flagged for transferring significant sums.

The optics were damning: Mantra's social media accounts went silent during the crash, and the token's price tanked in a low-liquidity window on a Sunday afternoon, a time when trading activity is typically minimal. To many, this resembled a classic rug pull — a scenario where insiders cash out, leaving retail investors holding worthless tokens.

However, Mantra's CEO, John Mullin, swiftly denied these allegations in a Cointelegraph AMA on April 14, 2025. Mullin insisted that neither the Mantra team, its key investors, nor its advisors had sold tokens. He claimed Arkham Intelligence had "mislabeled" the wallets, asserting that the company had provided a transparency report on April 8 detailing its key wallet addresses. Laser Digital and Shorooq Partners echoed Mullin's denials, with Laser stating, "Assertions linking Laser to 'investor selling' are factually incorrect," and Shorooq emphasizing its long-term equity stake in Mantra, not just token holdings.

Theory 2: Cascading Liquidations in a Low-Liquidity Market

The second theory, which gained traction as more details emerged, attributes the crash to a cascade of liquidations triggered by over-leveraged positions in a low-liquidity environment. Mantra's team, in a statement on X, described the event as "reckless liquidations," pointing to exchanges like Binance and OKX. Mullin suggested that a single large sale — possibly not even insider-driven — sparked a domino effect, liquidating leveraged positions and driving prices lower.

Binance's official statement on April 14 supported this narrative, noting that "cross-exchange liquidations" were responsible. The exchange explained that in a low-liquidity window, such as a Sunday afternoon, a single sale can trigger rapid price declines, especially when many traders are using high leverage. For example, a liquidation at $6.50 could push prices to $6.00 in a low-liquidity market, triggering further stop-loss orders and liquidations at $6.10, $6.00, and below.

Adding weight to this theory, Binance revealed it had imposed leverage limits on OM trading since January 2025, suggesting other exchanges may not have been as cautious. OKX, meanwhile, flagged "suspicious activity" across multiple platforms and noted significant changes in Mantra's tokenomics since October 2024, hinting at underlying vulnerabilities.

Curious Fact: The Sunday Effect

The crash's timing on a Sunday afternoon underscores a lesser-known vulnerability in crypto markets. Unlike traditional markets, crypto trades 24/7, but liquidity often dips on weekends, particularly Sundays. A 2023 study by CryptoCompare found that trading volumes on Sundays are, on average, 30% lower than on weekdays, making markets more susceptible to sharp price swings from large orders.

The Regulatory Elephant in the Room

Beyond the immediate causes, the Mantra crash exposes deeper issues in the crypto industry: a lack of standardized regulation and transparency. Unlike traditional markets, where insider trading is heavily monitored and public companies must disclose financial details, crypto projects operate with minimal oversight. Tokenomics, insider allocations, and wallet activities are often opaque, leaving investors vulnerable to manipulation or misinformation.

Noting that while Mantra's high-profile partnerships and top-50 status inspired confidence, the lack of uniform reporting standards made it difficult to assess risks. For instance, the absence of mandatory disclosures about insider token holdings or vesting schedules meant investors had little insight into potential sell-off risks. This opacity contrasts sharply with regulated markets, where such information is public, and insider sales are tracked.

Pie Chart: Investor Sentiment Post-Crash

To capture the community's divided opinions, a pie chart illustrates sentiment based on social media reactions:

Lessons for the Crypto Industry

The Mantra meltdown serves as a wake-up call for the crypto industry. While decentralization is a core tenet, the absence of regulatory frameworks leaves investors exposed to risks that traditional markets have mitigated through decades of oversight. This "uncomfortable conversation" about regulation is inevitable, particularly for projects beyond Bitcoin, which lack a centralized team. Ethereum and other altcoins, with their development teams and token allocations, face similar scrutiny.

Mantra's case also underscores the dangers of over-leveraged trading. High leverage amplifies gains but also magnifies losses, and in low-liquidity scenarios, it can trigger catastrophic cascades. Investors must approach such markets with caution, prioritizing risk management over speculative bets.

Conclusion: A Call for Transparency and Reflection

The Mantra crash of April 13, 2025, remains an unresolved mystery, with investigations ongoing as of April 14. Was it an insider dump, as early data suggested, or a liquidation cascade amplified by low liquidity and reckless leverage? Perhaps the truth lies in a combination of factors. Regardless, the incident highlights the crypto industry's growing pains, from inadequate transparency to the perils of unregulated markets.

As the crypto space matures, stakeholders — projects, exchanges, and investors — must advocate for clearer standards and better risk management. For readers, the question remains: What do you think caused Mantra's collapse? Was it a calculated insider move, a market misstep, or something else? Share your thoughts in the comments below, and let's keep this critical conversation alive.

Sources:

- Cointelegraph: Mantra CEO denies insider OM token dump

source: https://raglup.medium.com/the-mantra-meltdown-unraveling-a-6-to-0-50-crypto-crash-af56cf47b76d?source=rss-f56f44caad34------2

Is Zillow dying? (new stats)

| What's your opinion of Zillow? I ask agents this all the time. Their answers usually range from "I hate them" to "I want to watch them die a slow and painful death". But is Zillow dying? Nope, and their recent traffic proves it. (They're crushing the 25-49 age demographic.) Like it or not, all the best buyer and seller leads are surfing Zillow right now. I'm talking ready-to-go, pre-approved, come-list-my-home-right-now leads... many in the $500-750k range and higher. The problem is zillow wants to charge us ~$3000 per month to get their names and phone numbers. They call it "Premier Agent" (or "Flex" in some markets). But I've figure out a way to ethically capture these leads for free. Want to see how? I'm flipping select listings on zillow to divert ALL the leads to ME. (You can do this even if you don't have any listings.) It's pretty simple. Here's how I do it:

I'm sharing a step-by-step breakdown of the process in a live webinar tomorrow. Webinar: Zillow Hack to Get Free Leads I'm also giving away all the apps/tools you need to run this zillow hack. It probably sounds complicated, but the whole process takes 45 minutes from start to finish. It's easy even if you're a non-geek and have zero computer background. And this simple little hack gets me 50+ white-hot leads per month from zillow. Which is more than I got when we used to pay for the "Zillow Premier Agent" program. And you can rest assured, it's totally ethical and legal. As always, there's only 250 seats on today's webinar, so you need to register ASAP. >>> ONE CLICK REGISTER HERE <<< Here's what you'll get for joining

Hope to see you there. -Chris Jones |

Need listings yesterday?

|

Monday, April 14, 2025

How To Dominate the For Sale By Owner Niche

|